Vatican Finance

It is difficult to keep up with the never-ending car crash that is the Vatican Bank. Almost every week there are more “machines” piling on to the wreckage of this independent city/state.

Here is only a small, partial list.

The Vatican Bank was founded in 1942, three years after it became officially separated from Italy. The American archbishop Paul Marcinkus became president of the bank in 1971 and lasted until 1989 (he had no financial background). Rumours of money laundering started not long after his arrival. Their financial advisor was Michele Sindona, who was a freemason and had clear connections to Sicilian Mafia.

In 1982 it was revealed that Paul had also been director of Ambrosiano Overseas. The heads of Banco Ambrosiano were accused of transferring money out of the country into shady overseas banks, and they were linked to an illegal masonic lodge known as Propaganda Due (P2), which also had ties to the mafia. The Chairman, Roberto Calvi, was arrested, tried and sentenced. After his release on appeal, Calvi fled Italy and was found hanging under London’s Blackfriars Bridge. The Vatican bank paid out approx. $250,000 million to creditors for their involvement with the bank, although they claimed no responsibility.

Now, there is more to the Vatican than just the Vatican Bank (IOR): There is also the Administration of the Patrimony of the Apostolic See (APSA). APSA deals with anything that is owned by the Holy See in order to provide the funds necessary for the Roman Curia to function. They pay the employees, act as a purchasing office and manage their stock portfolio.

– Giampietro Nattino has served on the board of many Italian firms, is chairman of Banca Finnat Euramerica S.p.A (a home-office private Italian bank), and was a volunteer usher in the papal palace. This last title is what got him access to an APSA account, to which he was not entitled. A balance of more than €2 million was moved to Switzerland right before his accounts were closed. He was investigated for possible money laundering, insider trading and market manipulation.

– Cardinal Attilio Nicora was President of Administration of APSA from 2002 to 2011. Only Attilio could have authorised Giampietro’s use of an account. After his retirement from APSA, Attilio became the first President of the four-person Executive Board of the Vatican’s Financial Intelligence Authority (anti-money laundering, AIF) from January 2011 until January 2014. This branch is responsible for monitoring the banking activities of both IOR and APSA. When questioned, Attilio wrote in a letter to Reuters stating that “APSA was not a bank ‘because it does not lend money’”.

– Cardinal Attilio Nicora was President of Administration of APSA from 2002 to 2011. Only Attilio could have authorised Giampietro’s use of an account. After his retirement from APSA, Attilio became the first President of the four-person Executive Board of the Vatican’s Financial Intelligence Authority (anti-money laundering, AIF) from January 2011 until January 2014. This branch is responsible for monitoring the banking activities of both IOR and APSA. When questioned, Attilio wrote in a letter to Reuters stating that “APSA was not a bank ‘because it does not lend money’”.

– In 2012, Giulio Mattietti and Gianni Maritozzi covered up money laundering activities within IOR from AIF and inspectors from Moneyval. This wasn’t fully revealed until 2017.

– In June 2013, Monsignor Nunzio Scarano was charged with conspiracy to smuggle €20 million in cash into Italy from Switzerland to help friends (Salerno-based shipowners) avoid taxes, and also for using the Vatican bank for money laundering. He had worked at APSA for 22 years as a senior accountant.

– In June 2013, Monsignor Nunzio Scarano was charged with conspiracy to smuggle €20 million in cash into Italy from Switzerland to help friends (Salerno-based shipowners) avoid taxes, and also for using the Vatican bank for money laundering. He had worked at APSA for 22 years as a senior accountant.

– Paolo Cipriani and his deputy, Massimo Tulli, resigned in 2013 under charges of “bad management” to the tune of €47 million. In 2017, they were acquitted of €23 million alledged in money laundering.

– Bishop Nunzio Galantino, head of the Administration of APSA, acknowledged that in 2015 APSA loaned €50 million to finance the purchase of an Italian hospital (the Istituto Dermopatico dell’Immacolata), which was in debt for more than €800 million, even though APSA is “not a bank”. This no-lending policy had been put in place to exempt APSA from external oversight. The hospital income was unable to repay a loan of that size, so APSA looked for grant money from the USA. This is the Papal Foundation scandal.

– Bishop Nunzio Galantino, head of the Administration of APSA, acknowledged that in 2015 APSA loaned €50 million to finance the purchase of an Italian hospital (the Istituto Dermopatico dell’Immacolata), which was in debt for more than €800 million, even though APSA is “not a bank”. This no-lending policy had been put in place to exempt APSA from external oversight. The hospital income was unable to repay a loan of that size, so APSA looked for grant money from the USA. This is the Papal Foundation scandal.

The London Property Scandal – In A Nutshell

In 2014, the Secretariat of State (Cardinal Giovanni Angelo Becciu) financed Athena Capital of Raffaele Mincione with €200 million, through the granting of credit lines by Credit Suisse and the Italian Swiss Bank against the pledge of Vatican assets of around €454 million. With this, the Becciu purchased 45% of a scheme to build 49 luxury apartments from a former warehouse in London’s Chelsea area, as well as unrated bonds from Mincione’s holding company. Mincione charged the Vatican hedge fund fees.

It was a speculative investment which is against the Vatican guidelines, and with Britain’s vote to leave the EU, the real estate lost value. In the meantime, Becciu had moved on. Rather than sell at a loss, other officials at the Vatican’s Secretary of State decided the Church would buy the building outright.

Gianluigi Torzi had worked in various Italian family offices before starting his own brokerage firm in London. He was introduced to Fr. Alberto Perlasca, a senior official in the secretariat handling its investments. It was agreed that Torzi would act as intermediary in the sale and manage the property. Documents were signed and in Dec, 2018, Archbishop Edgar Peña Parra (Becciu’s replacement), sent the request to Credit Suisse to send the payment to Torzi’s shell company in Luxembourg.

Gianluigi Torzi had worked in various Italian family offices before starting his own brokerage firm in London. He was introduced to Fr. Alberto Perlasca, a senior official in the secretariat handling its investments. It was agreed that Torzi would act as intermediary in the sale and manage the property. Documents were signed and in Dec, 2018, Archbishop Edgar Peña Parra (Becciu’s replacement), sent the request to Credit Suisse to send the payment to Torzi’s shell company in Luxembourg.

No one ever talked about paying Torzi for his work.

Many months later, he asked to be paid £2.75m a year in fees, and a cut of profits from any sale. There are conflicting accounts of how much Torzi was finally paid – anywhere from €5 million to €15 million.

In the meantime, the AIF had been investigating the deal, but apparently not moving fast enough for the IOR, who filed a complaint. By now, the AIF has Juan Zarate (former security advisor to President Bush), as well as Maria Farina, Swiss financial consultant Marc Odendall and Joseph Pillay, who helped build up Singapore’s economy. These are all top players.

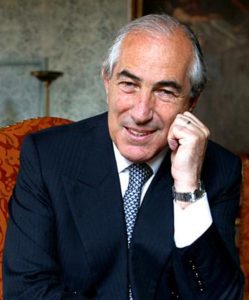

On October 1, 2019, Vatican police raided the AIF, seizing computers and documents related to their investigation over the London property. The director, Tommaso Di Ruzza, was suspended. René Brülhart, a Swiss lawyer, was also sacked (both of them appear in the photo on the right). Zarate resigned in disgust. Odendall also left.

That same day, police also raided the offices of the Holy See’s Secretariat of State. Monsignor Mauro Carlino, the head of documentation at the Secretariat of State, was suspended. Carlino was for years the personal secretary of Cardinal Becciu. Four others were also let go for apparently irregular millionaire financial transactions that had been carried out.

October 3, 2019, Giuseppe Pignatone, one of Italy’s most feared anti-mafia judges who helped bring down the head of the Sicilian Cosa Nostra, was chosen by Pope Francis as head of the Vatican’s prosecution service.

November, 2019, the Vatican is suspended from participation in the Egmont Group, through which 164 financial authorities share information and coordinate their work.

February, 2020, Vatican police raided the office and apartment of Msgr. Perlasca, taking documents and computers. He is accused by the Swiss judiciary of having millionaire accounts.

June, 2020, Gianluigi Torzi was arrested by Vatican police and charged with various counts of extortion, embezzlement, aggravated fraud and money-laundering. Torzi cooperated with Vatican police and provided all the documentation he had on the project. He was released after 10 days.

Cardinal Becciu

Now, the most recent casualty in this never ending saga is Cardinal Giovanni Angelo Becciu. He has a long history of financial finagling (besides the London saga) that was overlooked or not known by Pope Francis:

Now, the most recent casualty in this never ending saga is Cardinal Giovanni Angelo Becciu. He has a long history of financial finagling (besides the London saga) that was overlooked or not known by Pope Francis:

– 2001-2009: Angelo has another brother, Francesco, who owns a carpentry company which Angelo chose to furnish and repair several churches in Angola and later in Cuba, when Becciu was papal nuncio in those countries.

– 2013 – 2015: Card. Angelo Becciu obtained two loans from the Italian bishops’ conference to pay out two non-repayable loans of €300,000 each to the charity arm of his former diocese in Sardinia, “Spes Cooperative”. His brother, Tonino Becciu, is the legal representative of the cooperative.

– In 2018, Angelo gave a third sum to Spes Cooperative of €100,000 from Peter’s Pence, of which he had control as “sostituto”.

– Angelo also reportedly brought customers to yet another brother, Mario, who is majority partner and legal representative of Angel’s srl, a specialty food and beverage distributor.

– Angelo also has a niece, Maria Piera Becciu, who was hired through Becciu as the personal secretary of Fr. Franco Decaminada, the former president of Istituto Dermopatico dell’Immacolata (see above). Decaminada was arrested and imprisoned in 2013 for fraud, and eventually laicised.

Italian financial police have alleged that the 2018 sum was embezzled. The bishop of Ozieri, Corrado Melis, issued a statement saying the money was never used and remains in the diocesan coffers for a future project. The Becciu family said in its own statement that Spes never saw a dime of the money.

Angelo has denied any wrong doing, but recognises that by giving up his rights as a cardinal, he has put himself in danger of being judged by Vatican magistrates, and not solely the pope.

Article 11 of the Lateran Pacts states that the central bodies of the Catholic Church are exempt from any interference by the Italian State. If there are any lessons to be learned from this, it is to run – not walk – run, if ever offered a financial position within Vatican territory.