The International Tax Enforcement New BEPS step in the UK

We continue to report on the most important changes in the tax sphere that businesses face. And these changes are not only associated with the coronovirus.

New tax transparency and anti-avoidance measure in the EU directive, commonly known as DAC 6, will enter into force on 1 July 2020. HMRC published the final Regulations with clarifications, responses to the consultation. These new rules require cross border tax arrangements which meet the required conditions to be reported to either HMRC or another tax authority in the EU. We tried to explain the most important points that you need to prepare for in connection with the new regulation.

DAC6 introduces significant changes for tax advisors, service providers and taxpayers. In this article we have covered the most important aspects, however there are still many complex issues may significantly affect tax liability. Special attention should be given to the calculation of tax payable in order to avoid unnecessary penalties imposed by tax authorities.

At LEXeFISCAL LLP, our experts will be glad to help answering your questions, computing your tax liability and assisting you in solving any problems you may have relating to this topic. You can book your consultation at lexefiscal.com.

Introduction

Several tax transparency and anti-avoidance measures across different European countries have been created last year within the framework of the OECD’s final Base Erosion and Profit Shifting (BEPS) reports. Among these measures there are rules, known as Disclosable Arrangements (DAC 6), which are directed against aggressive tax avoidance across EU member states.

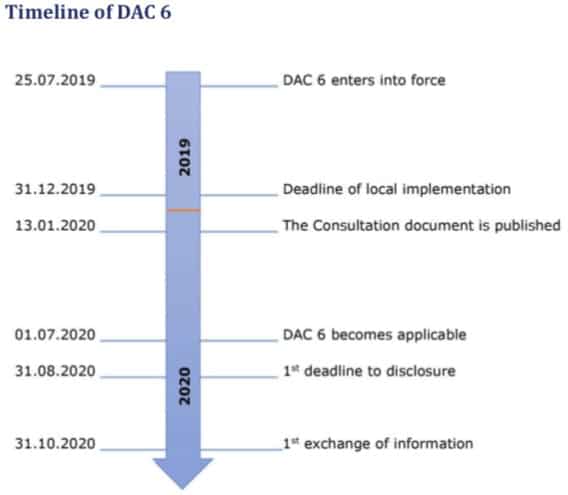

Briefly, on 25 June 2018, EU Directive 2018/822 amending Council Directive on administrative cooperation in the field of taxation 2011/16/ EU regarding mandatory automatic exchange of information in the field of taxation (1). The new International Tax Enforcement Regulations were published in draft in July 2019 in the United Kingdom, which implement EU Directive 2018/822 (2). On 13 January 2020, HM Revenue & Customs (HMRC) published the final Regulations with clarifications, responses to the consultation (3).

1. Disclosable Arrangements: what, where and who?

Fancy quote: DAC 6 requires entities and persons (known as intermediaries, sometimes – taxpayers) to report to HMRC information on certain cross-border tax arrangements if such arrangements contain “hallmarks” in order to resist against potentially aggressive tax planning.

Who must report in accordance with DAC 6?

The obligation to disclose is on all intermediaries, who are involved in cross-border tax arrangements. There are 2 different types of such intermediaries:

1) the person, who design and market the arrangements (known as promoters);

2) the person, who provide aid, assistance or advice according to such arrangements (known as service providers). These service providers must report if they know or could reasonably be expected to know that they assist or advice within the framework of cross-border arrangement with “hallmarks”.

The partners in partnerships could be intermediaries, in the same way that self-employed individuals could be intermediaries. The partnerships will be able to make relevant reports on behalf of partners who would otherwise have to report separately.

According to the Consultation document there will be no requirement for the intermediaries to do any additional due diligence to understand whether an arrangement is reportable or not.

What is a professional scope for intermediaries?

Disclosure requirement does not depend on professions. An intermediary may belong to any representatives of the legal, tax insurance and auditing companies, financial services providers (banks, fund initiators), investment and asset advisors etc.

Must taxpayers disclose information?

Yes, under certain circumstances. For example, in cross-border arrangements there is no intermediary subject to disclosure requirements, when a taxpayer designs and markets for their own use, known as “in-house arrangements” (4).

What is the territorial scope for intermediaries?

The intermediary and resident taxpayer should have a connection with UK. For example, if the intermediary has a specific domestic connection to the UK (e.g. is domiciled in the UK), it is accordingly subject to reporting requirements in the UK.

An intermediary will only have to report in one country.

It is does not whether the UK itself is affected by the cross-border tax arrangement or whether the effects occur solely outside the country (5).

What is “hallmark” of cross-border arrangements?

Hallmarks are specific characteristics of cross-border arrangements which might mean indication of a potential risk for tax planning or can lead to tax avoidance or evasion.

In which cases are hallmarks triggered?

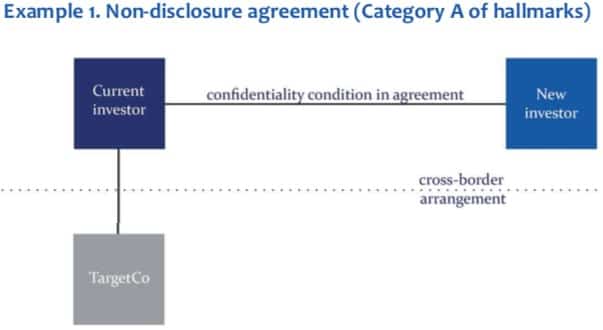

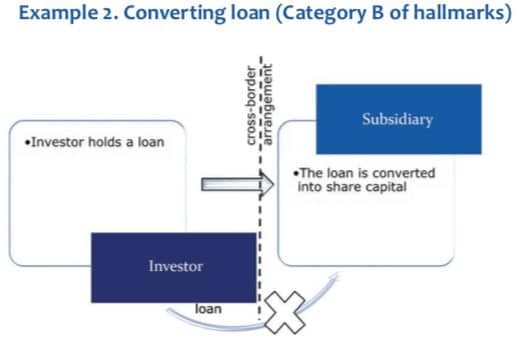

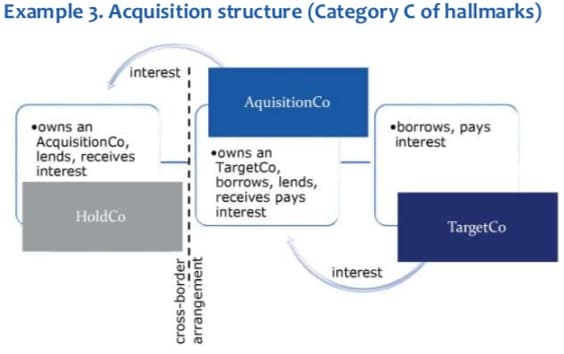

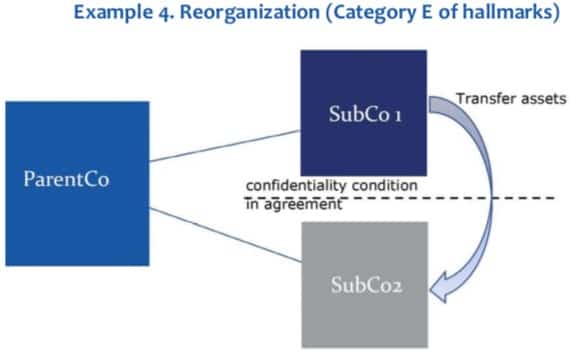

Below are some examples of reportable cases.

The case can be reportable, if a participant in the arrangement undertakes to comply with a condition of confidentiality which may require them not to disclose how the arrangement could secure a tax advantage from intermediaries or tax authorities.

“It does not whether the UK itself is affected by the cross-border tax arrangement or whether the effects occur solely outside the country.”

The case can be reportable, if arrangements involving cross-border payments and transfers may require disclosure under Category C hallmarks, e.g. payment to or near 0% tax jurisdiction.

“The tax advantage includes only arrangements, where the obtaining of the tax advantage cannot reasonably be regarded as consistent with the principles on which the relevant provisions that are relevant to the reportable cross-border arrangement are based.”

The case can be reportable, if arrangements include cross-border transfer of functions/risks/assets with more than 50% decrease in earnings before interest and tax during the next 3 years.

In all cases, is it necessary to submit a report?

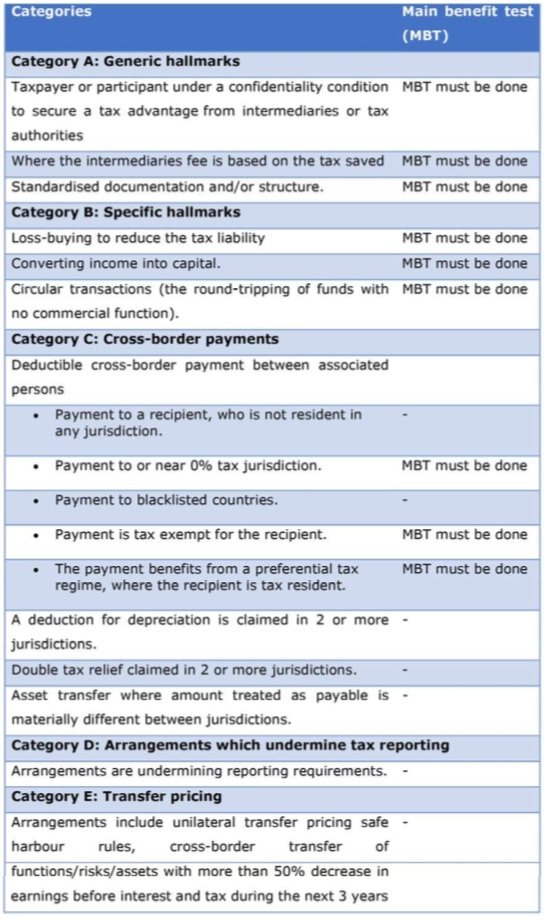

Some of the hallmarks are only triggered they fulfil the “main benefit test”. This test is satisfied if it can be established that the main benefit or one of the main benefits which a person may reasonably expect to derive from a cross-border arrangement is the obtaining of a tax advantage (6). The tax advantage includes only arrangements, where the obtaining of the tax advantage can-not reasonably be regarded as consistent with the principles on which the relevant provisions that are relevant to the reportable cross-border arrangement are based (7).

The following table shows the categories of hallmarks that are specified in the DAC 6, indicating which of them must comply with the “main benefit test”:

The table shows the categories of hallmarks that are specified in the DAC 6, indicating which of them must comply with the “main benefit test.

The table shows the categories of hallmarks that are specified in the DAC 6, indicating which of them must comply with the “main benefit test.

Where should a tax advantage arise?

The Consultation document provided that a tax advantage could be only an EU tax advantage, the provisions should not apply to non-EU tax advantage (8).

What type of taxes is covered by DAC 6?

DAC 6 covers almost all main direct taxes: income tax, corporation tax, trade tax, inheritance tax, gift tax and real estate transfer tax.

It does not cover value added tax, social security contributions, customs duties and harmonized excise duties (9).

Legal privilege of advisers

There is open issue with such reporting, because it can lead threatening rules with legal professional privilege (LPP). As general rule, if the intermediary is subject to legal professional privilege, the report must be made by the taxpayer.

HMRC will provide guidance on how the rules will operate. HMRC will also work with stakeholders to provide guidance on how the trigger points should be interpreted, balancing the aim of avoiding un- necessary reporting with the need to ensure that reporting obligations are not avoided or delayed (10).

2. Reporting

How is reporting carried out?

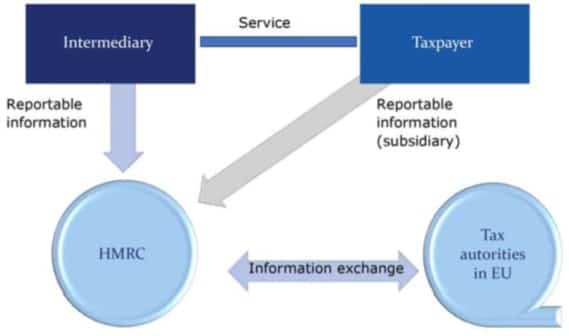

The intermediary or the taxpayers draft and submit the report to HMRC. The information received from these reports will be shared with other tax authorities, who will in turn share the information they receive.

“DAC 6 covers almost all main direct taxes: income tax, corporation tax, trade tax, inheritance tax, gift tax and real estate transfer tax.”

What are the deadlines for the report?

Filing is usually required within 30 days after the day, when the arrangement is made available for implementation. For an intermediary providing aid, assistance or advice it is within 30 days after the advice or assistance was provided (11).

“There is risk around duplicate reporting where multiple intermediaries

may report the same arrangement, which were also identified.”

Where should the report be made?

The report will be submitted in the jurisdiction in accordance with hierarchy, provided in the Council Directive 2018/82212:

1) The jurisdiction where the intermediary is tax resident.

2) The location of a PE connected with the provision of the relevant services.

3) Place of incorporation and

4) Location of a tax, consultancy or legal professional association with which the intermediary registered.

What data must be disclosed?

The following information should be disclosed:

1) Identification of intermediary (Tax residence; Name, date and place of birth (if an individual); Tax Identification Number).

2) A summary of the content of the arrangement.

3) Details of the relevant applicable hallmark(s).

4) The date on which the 1st step in implementation was made.

5) Data of the relevant local law.

6) The economic value of the cross-border arrangement.

7) The Member States, the entities there, are likely to be affected by this arrangement.

Does the same person need to file a report in different jurisdictions?

The same intermediary does not have an obligation to report in multiple jurisdictions (13). However, this position clearly exists only in the UK. It is necessary to check legislation of other jurisdictions where there is a risk of reporting.

Duplicate reporting

There is risk around duplicate re- porting where multiple intermediaries may report the same arrangement, which were also identified. However, the structure of the re- porting obligations is set out in the Council Directive 2018/822 and is not changeable. HMRC will provide examples to help intermediaries apply the rules in practice (14).

3. Penalty regime

The Consultation document changed the penalty regime. HRMC specified that the regime must be proportionate, and sufficiently flexible to deal with a range of behaviours.

What is the penalty for violation?

The default position will be a one-off penalty of up to £ 5,000 (15). Where the behaviour was not deliberate, or there are no other exacerbating factors such as repeated failures, the penalty will be a one-off penalty, with scope for reduction where there are mitigating factors.

The daily penalties will only be charged for serious failings including where the behaviour leading to the failure was deliberate. ?e daily penalties are subject to the determination of the First Tier Tribunal (FIT) (16).

Reasonable Procedures

Where a person has reasonable procedures in place to secure compliance with the rules, this will be taken into account in determining whether they have a reasonable excuse for a failure.

4. Enforcement and expected regulation

The rules and are set to come into force this July (DAC 6 becomes applicable). However, DAC 6 entered into force on 1 July 2019 (17). Thus, the entities, which have the obligations to report under DAC 6, should now check and analyze arrangements and prepare for drafting the first report in 2020.

When is the deadline for the first report?

The deadline of the 1st report is August 31, 2020. The 1st exchange of information between tax authorities will be done till October 31, 2020 (18).

For what period should I submit a report?

Report must be done for arrangements entered into from June 25, 2018 to June 30, 2020 (19).

Additional guidance and clarifications

The UK tax authority HMRC in- tends to issue detailed guidance before the rules come into force on 1 July 2020. HMRC will be working with industry bodies and other stakeholders to produce the guidance. For example, new HMRC guidance will provide examples to illustrate where a tax advantage will and will not be consistent with the underlying policy intent and will more detail on how the penalty regime will operate in practice and will provide examples of different levels of penalty.

However, for the entities, which have the obligations to report under DAC 6, it is necessary to comply with their obligations and to prepare for drafting the first report in 2020.

Brexit

The consultation document confirms that the UK’s commitment to tax transparency will not be weakened as a result of leaving the EU. However, the amendments may be needed to the regulations due to Brexit (20).

5. Summary

The amended DAC 6 is the following tax transparency and anti-avoidance measure within the framework of the BEPS plan, which leads to the fight against tax evasion and against aggressive tax avoidance.

“The Regulations and the Consultation document, first of all, allow to understand, how better to target compliance activity, and deter the entities from entering into abusive arrangements.”

The penalty regime has become softer and aims not to punish, but to deter those who make genuine mistakes. Nevertheless, there is a lack of certainty in a number of issues. HMRC’s guidance, which is expected, will be key in solving many practical problems.

1. Council Directive (EU) 2018/822 of 25 May 2018 amending Directive 2011/16/EU as regards mandatory automatic exchange of information in the field of taxation in relation ot reportable cross-border arrangements (Council Directive 2018/822).

2. The International Tax Enforcement (Disclosable Arrangements) Regulations 2019 (The Regulation).

3. International Tax Enforcement: disclosable arrangements. Summary of Responses (Consultation document).

4. Article 4, Part 2 of the Regulation; Article 8ab of the Council Directive 2018/822.

5. Question 2 of the Consultation document.

6.) Part 1, Annex 4 of the Council Directive 2018/822.

7.) Article 12, Part 2 of the Regulation.

8. Question 8 of the Consultation document.

9. Article 2, Part 1 of the Regulation.

10. Question 5 of the Consultation document.

11. Article 8ab of the Council Directive 2018/822.

12. Article 8ab of the Council Directive 2018/822.

13. Question 1, 14 of the Consultation document.

14. Question 2 of the Consultation document.

15. Introduction 2 of the Consultation document.

16. Introduction 2 of the Consultation document.

17. Article 27 of the Council Directive 2018/822.

18. Article 8ab of the Council Directive 2018/822.

19. Article 8ab of the Council Directive 2018/822.

20. Question 19 of the Consultation document, Next steps 4 of the Consultation document.