Invest in Gold or Bitcoin ?

Author, Jim Rickards. (Transcribed and adjusted for reading from his interview on businessinsider.com)

All markets have regulators, because all markets are subject to fraud. Bitcoin is not regulated, as it is not considered to be electronic money according to the law.

Are we supposed to believe that Bitcoin, being unregulated, it is not manipulated? Since it is unregulated – it is a magnet for all the manipulators.

One of the oldest tricks in the fraud book is called “Painting the tape”. An example of this is – you and your friends trade bitcoin back and forth, raising the price $100 each time. These exchanges get reported on the bitcoin exchanges, so an outsider who is naïve about this, sees the price going up – when it’s just a group trading it back and forth.

This manipulation of the market is also called Ramping (the market) or Wash trade.

This movement in the market brings in the suckers from the sidelines and then they buy it.

Miners. This is an expensive hobby that needs a lot of electricity. That’s why there is a population of miners by large water dams where electricity is produced. In China, they use coal for energy (the main cause of their air pollution) and have subsidised electricity. Or in Iceland, where it is so cold, all the computing helps keep them warm.

Bitcoin miners use as much electricity as the country of Nigeria, which has a population of 90 million ppl.

Miners will eventually hit a wall in terms of total bitcoin output. At that point, the miners have no incentive to mine.

Without the miners you have no one to validate the blockchain.

The Valuation Theory of Bitcoin

If you look at the cost of electricity and equipment used to mine bitcoin, and use that as a measure for the value of the bitcoin, that is called “intrinsic value”. We have not valued anything in this way since 1871.

David Ricardo came up with the theory of intrinsic value around 1812. Karl Marx played with it, saying yes, ‘labor doesn’t get their fair share’.

But – this is not how we value things today. This was all overthrown by Karl Manger in 1871, in Vienna. He understood the subjective theory of value.

Something is worth what people are willing to pay.

If it costs me $1,000 to find some gold, but the going price is $700, I’m not going to get $1,000.

Intrinsic value is meaningless. Subjective value is true of bitcoin and gold.

Bitcoin at $11,000 per coin is someone’s subjective valuation of what it is worth (leaving aside the fact that the price is manipulated – that’s a separate issue).

Subjective value is based on confidence. It’s a liquidity preference. If you are willing to transfer your dollars to get a bitcoin, you are expressing a liquidity preference for a different form of money.

But confidence is fragile.

It can be very easily lost and when it’s lost, it’s impossible to regain. There are lots of forms of money in the world.

Gold is money. Bitcoin is money. Euro, dollar – which one do you want? Where do you want to put your wealth? That a liquidity preference.

If you are throwing your wealth into bitcoin and that confidence is lost, what’s left?

Why gold over bitcoin?

Gold has been around a long time.

Bitcoin has never weathered a recession or financial crisis.

Bitcoin was invented in 2009. We did not have a recession or financial crisis in 2009.

We know how well the other asset classes perform in panics. Not just gold – but stocks, bonds – you can see how they perform. We have never seen bitcoin’s performance in a financial panic.

There is your first big uncertainty. In a pure economic sense, we don’t know how bitcoin will perform in a panic.

Leaving aside the criminality, it’s unregulated, the electricity usage, and ‘painting the tape’, and who is behind these exchanges.

One thing that could make bitcoin collapse – if one of the frauds were exposed. There is no one looking into these things – there are no regulators.

The government is only interested if you make a profit. With the gains, they are no different than buying IBM. The exchanges have to report all gains to the government or they get shut down.

What is your opinion?

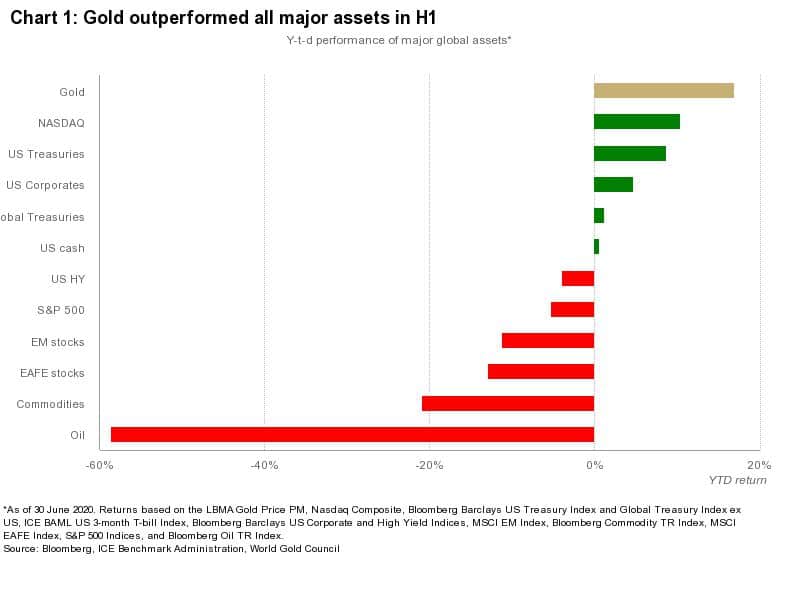

According to gold.org, gold outperformed all of the major asset classes in H1 2020, increasing by 16.8%.

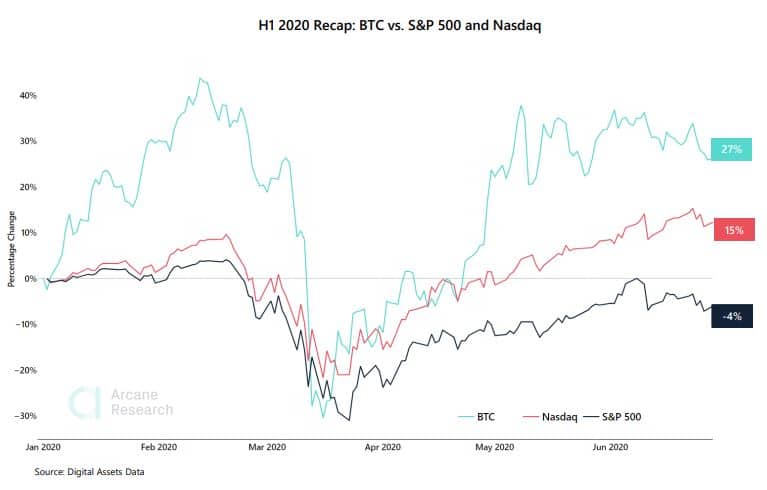

However, according to ethereumworldnews.com, bitcoin outperformed the stock market.

However, how much of that was do to manipulating the market?