The Hidden Truth Behind Gold

If you want to know how warm it is, look at the thermometer. If you want to know how fast the car is driving, look at the speedometer. And if you want to know how the global economy is doing, target the gold price.

If the world is calm and the assembly lines of the factories purr like cats, the gold price goes to sleep. He slumps wearily. If the world is nervous and her hands are trembling from the fear of the future, the price of gold will shoot up like a fountain of water. Yesterday, the financial markets reported an all-time high:

► Since the beginning of the year, the precious metal has gained 14% in value. It stands at $1744.6 and €1597 per troy ounce.

► Since 2001, when the price of gold averaged $271, the lowest since the turn of the millennium, it has increased by 544%. Since 1970 – the lowest level in the past 50 years – by 4718%.

► Anyone who has had shares in Daimler (minus 38% since the beginning of the year), BMW (minus 32.6%), Deutsche Bank (minus 10.4%) or the entire DAX (minus 16.4%) since the outbreak of the corona virus observed, the purchase of gold would have been much better served.

Gold is the secret world currency, also because one cannot multiply this commodity arbitrarily and cannot artificially produce it. The precious metal reassures because it cannot be manipulated. Meanwhile, in Germany alone, within four decades, four paper currencies never disappeared into the fog of history – the Rentenmark, the Reichsmark, the DDR-Mark and the D-Mark – survived gold as an effective store of value.

There are two main reasons for the current boom in the gold market:

First. In times of general uncertainty which fuels fear among stockholders and property owners, investors seek the emergency exit. Gold is the world’s safe haven currency, the “ultimate way out”, as economic historian Prof. Klemens Skibicki from Cologne Business School said yesterday.

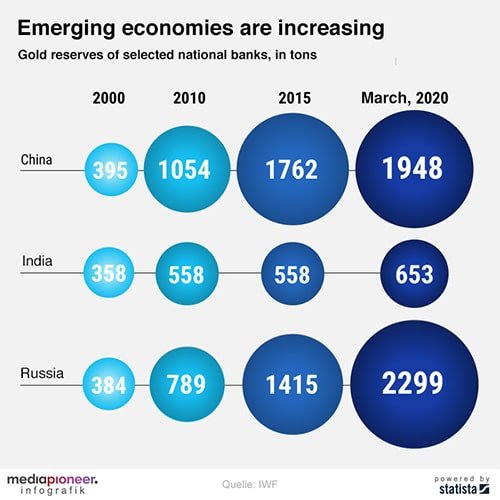

Secondly. Although the money reserves have lost their function in the monetary system due to the abolition of the gold standard, i.e. the coupling of paper money with physical gold, the central banks are still holding on to their gold reserves. Which developing economies such as Russia, India and China even buy. The economic historian says:

“This is a sign that the central banks do not believe in their own monetary system.”

While the European Central Bank kept its reserves stable, at least their value increased. Since 2000 by 210% to €22 billion at the end of 2019.

The US central bank Fed is bunkering by far the largest gold reserves. The 8133 tons make up 77% of the total reserves in the United States. This exceeds the gold reserves of the German central bank by more than double. With 3364 tons, the Bundesbank has the second-highest stock.

Conclusion: The central banks of all countries behave rationally and sluggishly at the same time. They swear by monetary stability and mistrust themselves. By flooding money, they buy politicians time. And as a reinsurance policy, they invest in gold.

Newsgate NY is a big fan of German journalist Gabor Steingart. In June 2018, he started to issue a Monday-Friday daily newsletter called “Steingarts Morning Briefing”. It is only available in German. We have decided that some of his insights are so valuable that they need to be translated. This weeks’ highlight (from May 20, 2020).