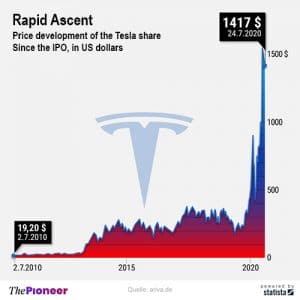

Tesla’s Stock Soaring High

The electrical pioneer Tesla’s soaring high on the stock exchange is steep – possibly too steep. The Tesla stock exchange valued at $59 billion in January 2018, and it is already $260 billion today. An increase of 340% in two and a half years. Tesla is rated higher than BMW (€39 billion), Daimler (€44 billion), General Motors (€32 billion), Fiat Chrysler (€14 billion) and VW (€74 billion) combined.

Despite all the fascination for the pioneer Elon Musk, who, in addition to the electrification of the automobile, is also driving the development of space, there are three tangible reasons that suggest that Tesla can not fundamentally justify this hype.

- The Palo Alto company is still not profitable in its core business of developing, building and selling cars. A profit of $2.18 is now reported per share, but the company owes this profit to politics, not the car market. The governments issue so-called CO2 certificates, which Tesla sells profitably to competitors. In the last quarter alone, this resale generated $428 million.

- Tesla saw declining sales in the past quarter. Around 90,000 cars were delivered. 5% less than in 2019, which is remarkable but not sensational in Corona times. For comparison: Toyota delivered 398,029 vehicles in the same period. VW has lost sales, but has gained market share in China.

- Many analysts have now become skeptical whether the high stock market valuation is really justified for Tesla. Goldman Sachs downgraded Tesla from “Buy” to “Neutral”. JP Morgan analyst Ryan Brinkman also gives a limited recommendation to sell (“Underweight”) and warns:

“Despite the slightly better second quarter, Tesla stocks are still heavily overvalued, as comparisons with industry leaders Toyota and VW show, which together are less valuable than Tesla.”

John Murphy of Bank of America puts it even more drastically:

“We believe Tesla’s upward spiral is driven by the stock itself rather than the fundamentals. The higher the share rises, the cheaper it is to finance this oversized growth, which is then rewarded by investors in the form of a higher share price. The current share price is detached from the fundamentals.”

Conclusion: The future is sold on the stock exchange. And sometimes the time afterwards.

Gabor Steingart

Gabor Steingart